Migration from existing medical plan to VHIS plan

Eligible customers can migrate their existing designated medical insurance plan of China Life (Overseas) (“designated plan”) to voluntary health insurance scheme (“VHIS plan”).

What is migration?

Eligible customers with designated plans will be given an opportunity once to migrate designated plans to VHIS plans during the plan migration application period. Migration may be subject to underwriting.

What are the plans eligible for migration to VHIS plan?

The designated plans eligible for migration are as follows:

• MasterCare Medical Plan Series

• Hospital Care Whole Life Insurance Plan Series

• I CARE Medical Insurance Plan Series

• iCare Medical Insurance Plan Series

• Health Guard Hospital Care Benefit Series*

• Hospital Care Benefit Series

• Hospital Care And Supplementary Benefit Series

• Hospital & Surgical Series

* Health Guard Hospital Care Benefit Series include Health Guard Hospital Care Benefit, Health Guard Hospital Care Benefit (Enhanced) and Health Guard Hospital Care Benefit (Enhanced) (N).

What are the VHIS plans available from China Life (Overseas)?

The VHIS plans available from the Company are as follows:

• VHIS Standard Plan – Guard Your Health Medical Insurance Plan

• VHIS Flexi Plan – Healthy Life Medical Insurance Plan Series

Please refer to the benefit schedule for the coverage of our VHIS plans.

Is migration subject to medical underwriting?

Migration may be subject to underwriting, depending on your original policy and the VHIS plan you have selected.

You can refer to the VHIS Mapping Table to find out whether underwriting is required for your migration.

What are the points to consider before migration?

Before migration, you should think about:

• Benefit coverage before and after migration

• Arrangement for surrender value (if any) of the original policy after migration

• Impact on supplementary benefit attached (if any) after migration of a basic plan

• Difference in premium

• Difference in exclusions

• Underwriting requirements upon migration

• Any new exclusions and/or loading that may apply after migration

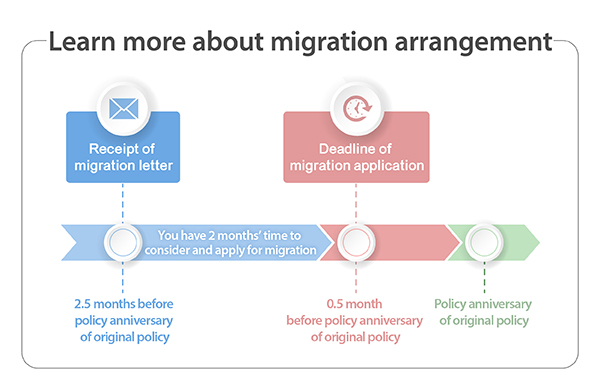

Learn more about migration arrangement

Terms and conditions

- The Application and Declaration Form for Voluntary Health Insurance Scheme (VHIS) Migration (the “Declaration Form”) must be submitted to the Company 75 days to 15 days (inclusive) prior to the policy anniversary of the original policy (“plan migration application period”). Submission out of the above period will be rejected; and

- For the original policy belongs to Hospital Care Whole Life Insurance Plan Series, the original policy will be terminated upon the new policy is effective (“complete migration”); surrender value (if any) and remaining balance of premiums and levy of the original policy will be payable to the policyholder by a crossed cheque in policy currency; and

- For the original policy belongs to MasterCare Medical Insurance Plan Series, the no claim deductible discount provided by the original policy will be forfeited and the number of policy years without claims (if applicable) under the new policy will be counted starting from zero upon complete migration; and

- The effective date of the following items will remain unchanged in the new policy (that is, the same as the original policy) if underwriting is not required when the original policy migrate to the new policy. Otherwise, they shall be counted starting from the effective date of the new policy:

(i) all exclusion(s);

(ii) loading rate(s);

(iii) special term(s) and condition(s)(if applicable); and - For pre-existing condition(s) that the policyholder or insured person was not aware and would not reasonably have been aware of at the time of submission of application, provided that underwriting is not required during migration from the original policy to the new policy, the waiting period of the new policy shall commence from the policy issuance date, policy effective date or the date of the latest reinstatement of the original policy (whichever is the latest); otherwise, the waiting period shall commence from the policy issuance date or policy effective date (whichever is earlier) of the new policy; and

- Section V (Family Details) and VI (Health and Related Details) of Life Insurance Application Form are not required for migration without underwriting according to the VHIS Mapping Table; and

- The eligible medical plan(s) under the original policy will be terminated on the effective date of the new policy upon completing migration; and

- Any remaining balance of premiums and levy (the “balance”) in the original policy (except Hospital Care Whole Life Insurance Plan Series), will be refunded in the original policy currency if the policy currency of the original policy and the new policy are the same; otherwise, the balance in the original policy will be converted into Hong Kong dollars equivalent to the policy currency of the new policy and be refunded; and

- If the eligible medical plan is a basic plan under the original policy, any supplementary benefit (s) attached under the original policy will be terminated upon complete migration; and

- If there are any additional exclusion(s) and/or loading rate(s) and/or special term(s) and condition(s) resulted from underwriting during migration (if applicable), the policyholder has the rights to cancel the migration and keep the eligible medical plan(s) under the original policy; and

- Under no circumstances, the new policy can be reversed to the original policy (including cooling off period) upon complete migration; and

- Please submit the Declaration Form together with other relevant application documents; and

- The Company shall have the final decision with respect to the application for VHIS migration.

Important Information

You have the right to purchase the medical insurance product as a standalone plan instead of bundling with other type(s) of insurance product.

Guard Your Health Medical Insurance Plan, Healthy Life Medical Insurance Plan series and Healthy Life Premier Medical Insurance Plan (if applicable) are certified plan under VHIS where the policy holder may enjoy a tax deduction. For details on tax deductions, please visit Inland Revenue Department (IRD) of HKSAR website and consult your tax and accounting advisors for tax advice.