FAQ Menu

In choosing the appropriate insurance product and coverage amount, you should consider your own protection needs and personal financial situation.

Whole life insurance offers lifelong protection and savings up to age 100 to the insured. Premium will usually not be changed after the policy has come into effect.

Endowment insurance has a fixed covered period and savings is the main feature. It will pay the sum assured if death occurs during the covered period. Different from term insurance, if the insured is still alive at the maturity date of the policy, he/she will also receive maturity value of the policy.

Term insurance provides life insurance protection to the insured for a specific period but does not contain any savings feature. The insurance company will pay the sum assured if death occurs during the covered period. However, if the insured is still alive at the maturity date of the policy, no proceeds will be provided to the insured by the insurance company. Premium for this type of insurance plan is usually the lowest out of the 3 types of insurance.

A rider is a supplementary benefit attached to the basic policy. The purpose of purchasing a rider is to increase the protection amount and coverage, including accidental, critical illnesses, hospitalization, and waiver of premium benefit. A rider cannot be purchased on a stand-alone basis and must be attached to a basic policy. If the basic policy expires, the rider will also be terminated.

Individual accidental insurance generally provides the following benefits:

Accidental Death Protection: a lump sum is payable to the beneficiary if the insured dies due to an accident.

Accidental Disability Protection: a claim is payable in accordance with the degree of the disablement due to an accident.

Accidental Medical Expenses Protection: funds are payable for the medical treatment of the bodily injuries of the insured caused by an accident.

Accidental Hospital allowance Protection: hospitalization allowance is payable during the period of the insured’s hospital confinement for medical treatment of bodily injuries caused by an accident.

Medical insurance usually provides medical expenses protection and hospital income protection. The medical expenses protection provides medical expenses reimbursements during the insured’s hospital confinement for medical treatment due to illness or injury. The hospital cash protection provides cash allowances based on the daily allowance and duration of the insured’s hospital confinement.

Critical Illness Insurance provides a lump sum when the insured is diagnosed of any of the critical illnesses listed in the benefit provision.

Waiver of Premium Benefit is a supplementary benefit to an insurance policy, waiving premiums otherwise payable while the insured is totally disabled, complete inability to engage in or continue to work for reward in any occupation, business or employment as a result of sickness or accident. In order to keep the insurance in force, the premium should continue to be paid until a written waiver notification is issued by our company.

Payor Benefit is a supplementary benefit to an insurance policy, waiving premiums otherwise payable till the payor reaches age 60 or the maturity of the premium payment period or the insured reaches the designed age (whichever is the earlier), while the payor dies before age 60 or complete inability to engage in or continue to work for reward in any occupation, business or employment as a result of sickness or accident. In order to keep the insurance in force, the premium should continue to be paid until a written waiver notification is issued by our company.

Trust is the essence of insurance contracts. As one party to a proposed insurance contract, the insurer relies upon the insured to reveal to the insurer all material facts about the risk, whether these are requested or not. This is a duty upon the proposed risk. A material fact is one which would influence the mind of a prudent underwriter in deciding whether to accept a risk and what terms to apply.

The Application Form has to be filled in and signed by the applicant and the insured. If the insured is a junior, the application has to be approved and signed by the statutory guardian. The points to note when filling in the Application Form include:

- Make sure that all details in the sections of Applicant, Proposed Life Insured and Beneficiary have been completely and accurately filled in; and

- Clearly fill in the names of the Basic Plan and any Riders, Sum Assured and product class; and

- Clearly fill in the Currency, Payment Mode and Dividend Option; and

- Supply true answers to the Health Details section, which is the most important section, to avoid any future disputes about future claims; and

- The Application Form has to be signed by both the Applicant and the Insured.

When you receive your policy documents, you should:

- Read the content and provisions carefully, and promptly raise any queries with us;

- Keep the policy documents in a safe place because when a claim arises, you are required to submit all policy-related documents to us;

- Tell your family members that you are insured and where you keep the policy documents;

- Notify the insurance company immediately of any material changes such as change in correspondence address, occupation or health;

- Review your policy regularly to ensure that the coverage can keep up with inflation and is sufficient to cover your needs.

We will process the request upon receipt of the completed《Request for Policy Maturity Form HK-CS-FIN-02》and the amount will be paid only on / or after the maturity date (applicable for application submitted before maturity date). Upon receipt of all necessary documents, we will process and arrange the payment within 14 working days.

If you would like to learn more about the processing time of value withdrawal and relevant information, please visit our web page Customer Service → Payment And Collection → Collection.

We offer three methods of collecting the Demand Draft as follows:

- Policyholder/Insured/Beneficiary comes to our Hong Kong Customer Service Center in Wan Chai to sign & collect the Demand Draft in person;

- Policyholder/ Insured/ Beneficiary signs the attached authorization letter with the reason for not collecting in person. The authorized person should come to our Hong Kong Customer Service Center in Wan Chai to sign & collect the Demand Draft on behalf of him/her;

- Demand Draft will be mailed to the correspondence address of the Policyholder/Insured/ Beneficiary in Mainland China unless China Life Insurance (Overseas) Company Limited is provided with the reason for not collecting the Demand Draft in person on the Special Payment Arrangement Request Form.

* Remarks: Please check with the local bank whether it can provide demand draft clearing service before application.

To avoid the Demand Draft from being dishonoured by Local Bank, PRC client is advised to confirm the following before application:

- The Payee must have a Foreign Currency Savings Account in PRC Bank of China(BOC)whilst he/she does not have bank account in Hong Kong;

- Client needs to check the local branches information on the website of PRC BOC;

- Client needs to call or visit the local branches to confirm whether the related branch can provide the Demand Draft clearing service.

The automatic premium loan interest rate of our insurance products is 7.00% per annum. For specific products, i.e. (C199)Rainbow Age (5 Year) Whole Life Plan (SE) and (C208)Superior Wealth (5-year) Whole Life Plan (SE), the automatic premium loan interest rate is 2.25% per annum. Please note our company may review and adjust the interest rate from time to time, our latest information shall prevail.

The loan interest rat of our insurance products is 7.00% per annum. Please note our company may review and adjust the intrest rate from time to time, our latest information shall prevail.

(Con't)

For example “Estimated Total Accumulated Cash Coupon/Guaranteed Annuity Payment and Interest (if applicable)” shown on the “Policy Maturity Notice” vs. “Guaranteed Amount” shown on the sales illustration document that was signed at the time of application and “Estimated Total Paid Amount” shown on the “Policy Maturity Notice” vs. “Total Surrender Value” shown on the sales illustration document that was signed at the time of application. Could you please explain the reasons behind?

Answer:

For our Participating Insurance Plans, the total sum of accumulated dividend (including guaranteed dividends, if any, and non-guaranteed dividends, if any) and interest on accumulated dividend, if any, is shown under “Estimated Total Accumulated Dividends and Interest (if applicable)” on the “Policy Maturity Notice”. The sum of Guaranteed Cash Coupon/Guaranteed Annuity and non-guaranteed interest on accumulated Cash Coupon/Guaranteed Annuity are displayed under “Estimated Total Accumulated Cash Coupon/Guaranteed Annuity Payments and Interest (if applicable)” in the “Policy Maturity Notice”.

The “Guaranteed Amount” in the sales illustration document is corresponding to the sum of the guaranteed dividends (if any) under the “Estimated Total Accumulated Dividends and Interest (if applicable)” and the Cash Coupon/Guaranteed Annuity under the “Estimated Total Accumulated Cash Coupon/Guaranteed Annuity Payments and Interest (if applicable)” in the “Policy Maturity Notice”.

The change in terminology and format display are in compliance with the latest regulatory requirement for policyholders’ better understanding of the figures and have no impact on policyholders’ benefits under the policy.

Policyholders of Participating Insurance Plans can enjoy the potential surplus arising from the long term operation of the participating fund via a form of non-guaranteed dividend in addition to the guaranteed benefits. Your premiums will usually be allocated into a relevant participating fund and will be invested in a variety of asset classes according to our investment strategy. We will manage the relevant participating fund in a prudent manner and aim to ensure a fair distribution of surplus and risks between policyholders and shareholders, and among different groups of policyholders.

As dividends are mainly affected by the overall performance of the participating business, in order to alleviate the volatility of achieved gains and losses and the future uncertainties, in particular, future investment returns, we may take moderate smoothing measures to achieve relatively more stable dividends and strive to meet policyholders’ reasonable expectation. We will maintain a fair distribution method or sharing ratio, and appropriate grouping to ensure policyholders are treated fairly, and to ensure policyholders’ benefit expectation and rights are protected.

The current dividend projection is not guaranteed. We will review and declare the dividend at least once a year. When determining the dividend, we will consider the overall performance of all relevant policies on factors including but not limited to past experience as well as future prospect of investment returns, claims and surrenders:

● Investment return - including the interest income, dividend income, investment outlook and changes to asset values.

● Claims - including the costs of providing death benefit as well as other benefits under the product(s).

● Surrenders - including policy termination, partial surrenders and the corresponding experience and impact.

If there are any changes in the actual dividends against the illustration or to the projected future dividends, such changes will be reflected in the policy anniversary statement. The declaration of actual dividends is recommended by the Appointed Actuary and is subject to the approval of the Board (including one or more Independent Non-Executive Director(s)). For products that are associated with an element of non-guaranteed accumulation interest rate, we will consider past investment experience as well as future expected return and other related factors when determining this non-guaranteed interest rate. If there are changes from market, expectation or policyholder behavior, the Company may apply reasonable adjustments to the non-guaranteed interest rate.

Due to the aforesaid reason, the actual sum of dividends and interest upon maturity may be lower or higher than that illustrated at the time of application.

In addition, the “Estimated Total Paid Amount” displayed in the “Policy Maturity Notice” refers to all available policy value less any deductible including “Estimated Total Policy Loan with interest (if applicable)” and “Estimated Total Outstanding Premium with interest (if applicable)”. As such, the actual maturity value would be lower than the projected value in the sales illustration document.

CRS has been in effect since 1 January 2017. Under CRS Ordinance, all financial institutions in Hong Kong (including China Life Insurance (Overseas) Company Limited Hong Kong Branch) are required by law to perform due diligence on account holders, and to obtain self-certifications form and/or further information from account holders in order to document the tax status of the account holders. Please update us your CRS status within 90 days after you have received our notification. If you do not update us your CRS status within the above deadline, we would be required to submit the existing records in our company to Inland Revenue Department.

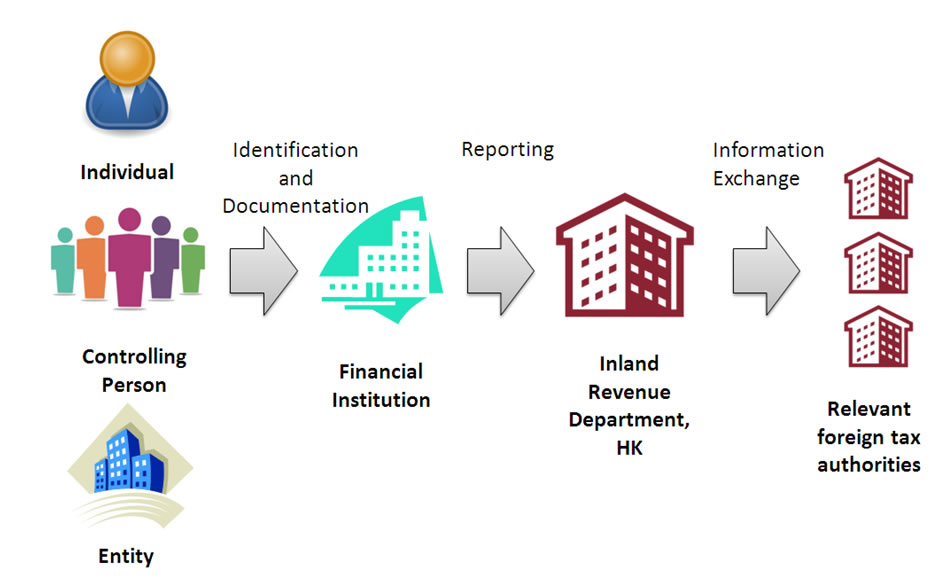

The Common Reporting Standard (CRS), a FATCA like regime, is a global standard for countries to exchange information about offshore accounts. It aims to prevent offshore tax evasion by giving countries transparency about offshore financial assets. It was developed by the Organization for Economic Cooperation and Development (OECD), encourage the government from different countries to obtain the details of account information from their financial institutions, and to automatically exchange such information annually with the tax jurisdictions of the place of residence of account holder. CRS applies to both individuals and legal entities. For details of activated exchange relationship for CRS information, please visit here.

Financial institutions are asked to identify customers’ tax residencies and report financial accounts held directly or indirectly by foreign tax residents to Inland Revenue Department of Hong Kong, who then exchange the information.

CLIO identifies customers’ tax residencies. Then we report financial accounts held directly or indirectly by foreign tax residents to Inland Revenue Department of Hong Kong.

If the customers are affected by CRS, we will ask customers to complete a self-certification form that includes his/her tax residency. If there is any circumstances change on customer’s tax residence and they will affect CRS classification, then customers will need to let us know as well as complete a new self-certification form.

To download a “Self-Certification” form, please visit our index page of Form Servicing in "Forms Download" webpage.

Under section 80 (2E) of the Inland Revenue Ordinance, any person who, in making a self-certification makes a statement that is misleading, false or incorrect in a material particular, and that the account holder knows, or is reckless as to whether, the statement is misleading, false or incorrect in a material particular, he shall be guilty of an offense and shall be liable on conviction to a fine at level 3 (being HKD 10,000)

For more details see the OECD website or contact your tax advisor.

The IA is a regulatory body independent of the Government and the industry. Empowered by the Insurance Ordinance (Cap. 41), the IA's principal function is to regulate and supervise the insurance industry to promote the general stability of the insurance industry and protect policyholders.

Levy is made by the Chief Executive in Council under Section 134 of Insurance Ordinance (Cap. 41). The levy will be imposed on policyholders and collected by insurers to remit to the IA in order to support the operational cost of IA.

The Insurance (Levy) Order will come into operation on 1 January 2018. All policies with policy inception date on/after 1 January 2018 will be required to pay the levy. For all existing policies that premiums are required to be paid, levy will be collected from the Policy Anniversary Date in 2018.

Policyholder must pay levy together with premium.

Policyholder must pay levy together with premium. If the Policyholder does not pay the levy on time, the IA may impose on the policy holder a pecuniary penalty of up to HK$5,000. The IA may recover outstanding levy as a civil debt due to it.

The amount of levy is calculated as a percentage of premium. The levy rates prescribed under The Insurance (Levy) Order on life insurance policies are as follows:

| Policy Date / Policy Anniversary Date begins in the following period |

Levy Rate | Yearly Levy Cap* (HK$) | |

|---|---|---|---|

| Phase 1 | 1 January 2018 - 31 March 2019 (both dates inclusive) |

0.040% | 40 |

| Phase 2 | 1 April 2019 - 31 March 2020 (both dates inclusive) |

0.060% | 60 |

| Phase 3 | 1 April 2020 - 31 March 2021 (both dates inclusive)) |

0.085% | 85 |

| Phase 4 | 1 April 2021 onwards (date inclusive) |

0.100% | 100 |

* Except HKD, other currencies are translated at the exchange rate applicable at the date of the transaction.

Example 1

The next Policy Anniversary Date and Premium Due Date of Ms. Chan’s policy is 1 February 2018. The annual premium of the policy is HK$9,000. In the policy year of 2018 (i.e. Phase 1), the amount of levy payable for the premium due of 1 February 2018 is calculated as follows:

(Required Premium) HK$9,000 x (Levy Rate) 0.040% = HK$3.6

Given that the yearly levy cap in Phase 1 is HK$40 and the calculation result of the amount of levy payable for Ms. Chan’s policy is within the cap level, the amount of levy payable for the premium due of 1 February 2018 is HK$3.6, and the total payable (including premium and levy payable) for Ms. Chan’s policy is HK$9,003.6.

Example 2

The next Policy Anniversary Date and Premium Due Date of Mr. Lee’s policy is 15 March 2018. The annual premium of the policy is HK$150,000. In the policy year of 2018 (i.e. Phase 1), the amount of levy payable for the premium due of 15 March 2018 is calculated as follows:

(Required Premium) HK$150,000 x (Levy Rate) 0.040% = HK$60

However, as the yearly levy cap in Phase 1 is HK$40 and the calculation result of the amount of levy payable for Mr. Lee’s policy exceeds the cap level, the amount of levy payable for the premium due of 15 March 2018 is HK$40, and the total payable (including premium and levy payable) for Mr. Lee’s policy is HK$150,040.

Example 3

The next Policy Anniversary Date of Mr. Cheung’s policy is 12 May 2018 and the monthly premium is HK$15,000. In the policy year of 2018 (i.e. Phase 1), the levy payable are as follows (HK$ applies to all amounts in below table):

| Premium Due Date | Required Premium (1) | Levy Rate | Levy (2) | Total Amount (1)+(2) |

|---|---|---|---|---|

| 12 May 2018 | 15,000 | 0.040% | 6.00 | 15,006 |

| 12 June 2018 | 15,000 | 0.040% | 6.00 | 15,006 |

| 12 July 2018 | 15,000 | 0.040% | 6.00 | 15,006 |

| 12 August 2018 | 15,000 | 0.040% | 6.00 | 15,006 |

| 12 September 2018 | 15,000 | 0.040% | 6.00 | 15,006 |

| 12 October 2018 | 15,000 | 0.040% | 6.00 | 15,006 |

| 12 November 2018 | 15,000 | 0.040% | 4.001 | 15,004 |

| 12 December 2018 | 15,000 | 0.040% | 0.002 | 15,000 |

| 12 January 2019 | 15,000 | 0.040% | 0.002 | 15,000 |

| 12 February 2019 | 15,000 | 0.040% | 0.002 | 15,000 |

| 12 March 2019 | 15,000 | 0.040% | 0.002 | 15,000 |

| 12 April 2019 | 15,000 | 0.040% | 0.002 | 15,000 |

- The yearly levy cap in Phase 1 is HK$40. From 12 May 2018 to 11 November 2018, the total levy payable is HK$36, hence the levy payable on 12 November 2018 is only HK$4.

- The yearly levy cap in Phase 1 is HK$40. Since the total levy payable from 12 May 2018 to 11 December 2018 have been accumulated to the yearly levy cap, Ms. Cheung is not required to pay any levy in the remaining months of the concerned policy year.

No. As stipulated in the Insurance (Levy) Regulation, policyholder must pay the levy to the IA through the insurance company.

We will deduct the required premium and levy from your payment and/or the premium suspense account of your policy. In case your payment and/or the balance of the premium suspense account of your policy are insufficient to pay for both required premium and levy, we will settle the required premium only but not the levy.

Yes. If you selected to pay premiums by automatic payment options, e.g. autopay, dividend, cash coupons and guaranteed annuity payment, we will deduct the required premium and the corresponding levy at the same time (unless it has been rejected by the Policyholder in writing). If you do not accept the aforesaid default arrangement, you may change the payment method to non-automatic payment options to settle the premium and levy.

No. If we have not received your premium payment and advance the premium due by automatic non-forfeiture options (e.g. Automatic Premium Loan, Policy Deposit, etc.) to keep the policy in force according to the policy contract, the corresponding levy on the premium due shall not be settled by the same non-forfeiture option, and you should make the levy payment by other means. Your payment will be used to settle the overdue premiums and interest (if any) first, the remaining balance (if any) will be used to settle the levy.

If you have prepaid premiums under your policy, your may refer to the “Payment Notice” which will be sent to you before the modal premium due date. The levy payable will be specified in the notice.

If you pay premiums by autopay, we will deduct the required premium and the corresponding levy from your bank account at the same time. You may seek advice from the bank or reset the withdrawal limit with the bank.

We will deduct the corresponding levy together with the required premium through autopay. If your withdrawal limit on autopay is not enough to pay the premium and levy at the same time, we suggest you to seek advice from the bank or reset the withdrawal limit with the bank if needed.

No. If you pay the premium without levy, policy will not be terminated. However, if the Policyholder failed to pay the levy in a timely manner, the IA may impose on the Policyholder a pecuniary penalty of up to HK$5,000 and may recover outstanding levy as a civil debt due to it.

Even you pay the premium without levy, in order to protect your policy interest, we still accept your application for addition of riders/policy changes. However, if the Policyholder failed to pay the levy in a timely manner, the IA may impose on the Policyholder a pecuniary penalty of up to HK$5,000 and may recover outstanding levy as a civil debt due to it.

No.

Life insurance policy replacement means you are using/ intend to use the funds from the following transactions, which happened or will be happened during 12 months immediately prior to/ following the application date* of the new life insurance policy, to fund the purchase of the new life insurance policy :

- some or all of the funds arising from the existing life insurance policy, including but not limited to:

- surrender / partially surrender to obtain its surrender value

- taking out a policy loan (including automatic premium loan or collateral assignment)

- withdrawing policy values (e.g. cash out dividends or redeem fund units etc.)

- reduced paid up insurance

- any saving made by reducing the premium payable under the existing life insurance policy, including but not limited to:

- lapsation (e.g. by non-payment of premium)

- exercising the right to a premium holiday under your existing life insurance policy

* Application date is the date on which the application form of the new life insurance policy is signed by you.

- where the new life insurance policy is being effected solely by reason of the existing life insurance policy being converted into the new life insurance policy under the provisions of the existing life insurance policy;

- where the existing life insurance policy and the new life insurance policy are with the same authorized insurer and the new life insurance policy is being effected solely by reason of the existing life insurance policy being converted or migrated into the new life insurance policy under a conversion or migration program offered by the insurer, in which re-underwriting is not required;

- where the only change made to the existing life insurance policy, relates to the coverage under a rider on the existing life insurance policy and no change is made to the life coverage of the basic plan of such policy; and

- where the life insurance policy is purchased in place of an existing life insurance policy cancelled during its cooling-off period.

You may suffer actual and potential losses in case of policy replacement. To protect your interest, you should carefully compare your existing and the new life insurance policies, and assess below aspects to see whether the policy replacement is of your best interests before making a decision:

Financial Implications

Insurability Implications

Claims Eligibility Implications

If you decided or considering to replace your life insurance policy with a new life insurance policy, you should:

- Answer the question stated in “Replacement Declaration” carefully. If you are uncertain about the definition of policy replacement, please approach your licensed insurance intermediary and / or insurer of your existing life insurance policy to obtain further information;

- If your answer in “Replacement Declaration” is “Yes” or “Not yet decided”, your licensed insurance intermediary must explain the “Important Facts Statement - Policy Replacement” (“IFS-PR") to you. You should read all items in the IFS-PR carefully and check that licensed insurance intermediary has explained the information on the IFS-PR and you understand the content of IFS-PR before you sign it;

- If you do not understand any of the information in IFS-PR or the advice or information provided to you by your licensed insurance intermediary is different from the information in the IFS-PR, please do not sign this IFS-PR and do not proceed with replacing your existing Life Policy;

- If you have question about policy replacement, please visit the Insurance Authority's website at www.ia.org.hk.

| Policy arrangement | Consider as policy replacement? | |

|---|---|---|

| 1 | Reduced the sum assured of the existing life insurance policy on 23 Oct 2019 | Yes. Reduced sum assured of the existing life insurance policy in the past 12 months of the application of the new life insurance policy. |

| 2 | Intend to allow the existing life insurance policy generating automatic premium loan by suspending the premium payment starting from the next premium due date on 30 Sep 2020. | Yes. Automatic premium loan is also considered as policy loan and it is about to take place in the next 12 months upon the application of the new life insurance policy. |

| 3 | Withdrew cash coupons from the existing life insurance policy on 12 May 2020 | Yes. Cash coupons is considered as a part of policy value and the withdrawal took place in the past 12 months of the application of the new life insurance policy. |

| 4 | Intend to suspend the premium payment of the existing term life insurance policy (no saving element) in the next premium due date on 20 Sep 2021. | Yes. Term life insurance plan does not have any saving element. Hence, the existing term life insurance policy will be lapsed in the next 12 months upon the application of the new life insurance policy after suspend the premium payment. |

| 5 | The existing life insurance policy has been under a premium holiday since 1 Jan 2018. | No. The existing life insurance is not exercising premium holiday during 12 months immediately prior to the application of the new life insurance policy. |

| 6 | Cancelled the medical rider of the existing life insurance policy on 23 Sept 2020. | No. The only change relates to the coverage under a rider on the existing life insurance policy and no change is made to the life coverage of the basic plan of such policy. |

We are dedicated to providing you a considerate and efficient claim service. We aim to swiftly process your claim upon receipt of all necessary documents as requested by our company, and provide updates on our decision or progress within the designated time frame as outlined below. However, the actual processing time may vary depending on the types of the claim, the complexity of the claim, the completeness of the information submitted and the timeliness of responses from relevant parties (e.g medical facilities).

| E-claim - Superspeed Claim3 | 1 working day1 |

| E-claim - Express Claim4 | 3 working days1 |

| Other claim applications | 4-10 working days2 |

Remarks:

- Only applicable for the claim applications that have been accompanied by all the necessary documents as requested by our company in the initial submission.

- Upon receipt of all necessary documents as requested by our company.

- For Hospitalization Benefit (Inpatient Expenses / Hospital Income), Out-patient Expenses, Accidental Medical Expenses and New Born Baby Bonus(The amount of each medical receipt must be HKD 10,000 or below).

- For Hospitalization Benefit (Inpatient Expense/Hospital Income), Outpatient Expenses, Accidental Benefit (Accidental Medical Expenses/Accidental Weekly Income), Critical Illness, Female Protection, Waiver of Premium, Long Term Sick Leave, Disability Benefit, Terminal Illness and Share Happiness Reward (the amount of each medical receipt or at least one receipt of Outpatient/Hospitalization/Accidental Medical Expenses is above HKD10,000).

| E-claim - Outpatient | 1 working day1 |

| Other claim applications | 5-10 working days2 |

Remarks:

- Only applicable for the claim applications that have been accompanied by all the necessary documents as requested by our company in the initial submission.

- Upon receipt of all necessary documents as requested by our company.

Notes

The information and descriptions contained herein are provided solely for general informational purposes, they are not intended to be complete descriptions of all terms, exclusions and conditions applicable to the products and services; neither are they intended to provide professional legal advice. For complete details please refer to the actual policy or the relevant product or services agreement; for legal advice please consult professional advisor.