FAQS

FAQ Menu

CRS has been in effect since 1 January 2017. Under CRS Ordinance, all financial institutions in Hong Kong (including China Life Insurance (Overseas) Company Limited Hong Kong Branch) are required by law to perform due diligence on account holders, and to obtain self-certifications form and/or further information from account holders in order to document the tax status of the account holders. Please update us your CRS status within 90 days after you have received our notification. If you do not update us your CRS status within the above deadline, we would be required to submit the existing records in our company to Inland Revenue Department.

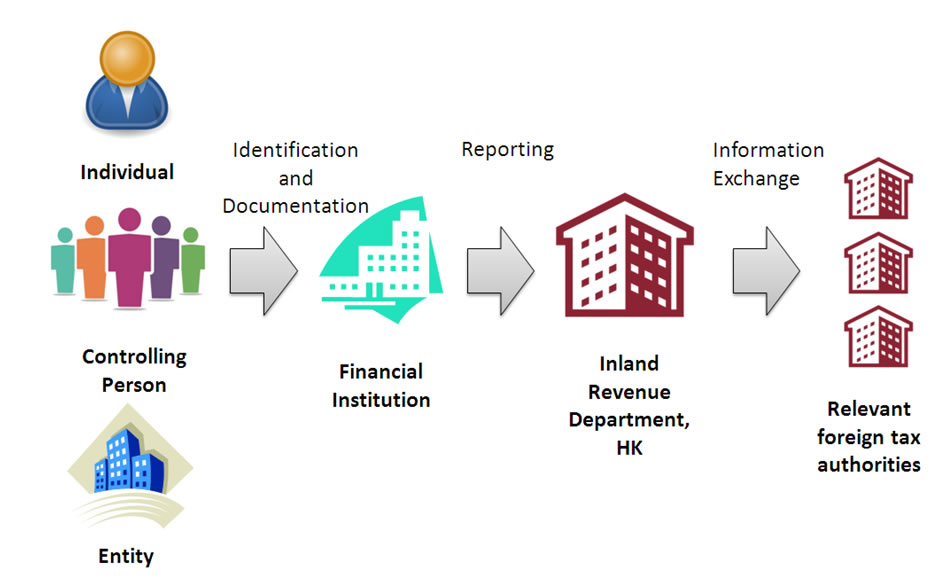

The Common Reporting Standard (CRS), a FATCA like regime, is a global standard for countries to exchange information about offshore accounts. It aims to prevent offshore tax evasion by giving countries transparency about offshore financial assets. It was developed by the Organization for Economic Cooperation and Development (OECD), encourage the government from different countries to obtain the details of account information from their financial institutions, and to automatically exchange such information annually with the tax jurisdictions of the place of residence of account holder. CRS applies to both individuals and legal entities. For details of activated exchange relationship for CRS information, please visit here.

Financial institutions are asked to identify customers’ tax residencies and report financial accounts held directly or indirectly by foreign tax residents to Inland Revenue Department of Hong Kong, who then exchange the information.

CLIO identifies customers’ tax residencies. Then we report financial accounts held directly or indirectly by foreign tax residents to Inland Revenue Department of Hong Kong.

If the customers are affected by CRS, we will ask customers to complete a self-certification form that includes his/her tax residency. If there is any circumstances change on customer’s tax residence and they will affect CRS classification, then customers will need to let us know as well as complete a new self-certification form.

To download a “Self-Certification” form, please visit our index page of Form Servicing in "Forms Download" webpage.

Under section 80 (2E) of the Inland Revenue Ordinance, any person who, in making a self-certification makes a statement that is misleading, false or incorrect in a material particular, and that the account holder knows, or is reckless as to whether, the statement is misleading, false or incorrect in a material particular, he shall be guilty of an offense and shall be liable on conviction to a fine at level 3 (being HKD 10,000)

For more details see the OECD website or contact your tax advisor.